This is the 1st installment of the series 7 Alternatives To The Stock Market

Before I begin discussing the details however, I need to emphasize something:

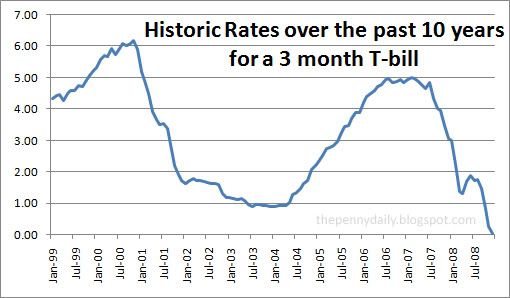

The Federal Reserve, in light of the recent economic troubles, has lowered interest rates to nearly zero. I talked about this in detail a week ago in this post. This means that the rates that are being given at the moment for treasury securities as well as other forms of investment are ABNORMALLY low. The graph below shows how the investment rate for one type of treasury security has changed over the past ten years.

Treasury securities come in different forms, based upon how long they take to mature.

- Treasury Bills (T-Bills)

- 4 weeks (one month)

- 13 weeks (three months)

- 26 weeks (six months)

- 52 weeks (one year)

- 4 weeks (one month)

- Treasury Notes(T-Notes)

- 2 years

- 3 years

- 5 years

- 10 years

- 2 years

- Treasury Bonds (T-bonds)

- 30 years

T-Bonds and T-Notes pay interest every 6 months until the security matures. So if you buy $10,000 worth of 5 year T-Notes at an interest rate of 5%, you will get $50 a month until the end of the 5th year when you will get $9600 (your original investment of $9500 plus the final interest payment).

Technically you don’t simply purchase these securities. They are auctioned off. There are two ways to bid, competitive and non-competitive. In competitive bidding, you would specify the rate you wanted and it can either be accepted or rejected based on the outcome of the auction. However, for the less experienced investor, I recommend you use the non-competitive bid. In this case, you just accept the rate determined at the auction. You can look more into the auction process, as well as purchase a Treasury security at TreasuryDirect.

Now that you know what treasury securities are, what should you consider before purchasing one? To start with, your money is guaranteed by the United States Government. You can’t get much safer than that, especially in hard economic times like right now when the stock market is not the most reliable place to invest, especially in the short term. You CANNOT lose money on a security if you keep it to maturity, which is a great benefit. Also, interest you earn on the treasury securities is exempt from state and local taxes. Interest rates are locked in when you buy, which can be a positive or negative thing. If interest rates drop while your security is maturing, you are making more money than, say if you had kept your money in a savings account. For example, if your treasury is locked in at 6% and the Fed lowers rates to 4%, the bank will probably offer you a lower rate than the treasury. However, if the rates rise, you are not making as much money.

It is possible to sell Treasury Securities before they mature. There is a market in Chicago that works similar to the stock market. For a small fee, you can sell your security to other investors. However, the amount of money you can get is dependent on the rates (controlled by the Fed) when you are trying to sell it. If the lowers the interest rates after you bought your security, you are likely to sell your security for a profit. If your treasury is locked in at 3% and the fed lowers the rates to 2%, your treasury is worth more since you now have a higher yield than the market. Wouldn't you be willing to pay more to get a treasury that yields 3% rather than one that yields 2%?

However, if rates have gone up since you bought your security; you will likely have to sell for a loss. Let's say you have a T-Bill with an interest rate of 3% and the fed raises its rates to 5%. All new T-Bills are now being sold with a 5% interest rate. Why would someone pay you for your $1000 T-Bill when they can just buy their own and get the higher interest rate? Nobody is going to give you $970 when they could buy their own for $950. Thus the only way to entice someone to buy is to offer it at a loss, such as selling it for $920.

If you are looking for an emergency fund that you’ll need to tap into at a moment’s notice, securities are not the right place for your money. You have to wait for it to mature before you can cash it in. If you need the money before it matures, you might have to sell your treasury at a loss. However, what if you know you won't need the money for a few years, and you do not like the risk of the stock market? Treasury securities would be a good choice in this situation. Some people also like to put their money in securities with spaced-out maturities, such as splitting your money between 3 and 6 month T-Bills that mature two months apart. This way every two months you can re-evaluate whether Treasury Securities are earning you the best rate. If they are, you can just immediately reinvest it; if not you can remove your money and invest it elsewhere. It also gives you better liquidity than if all your securities matured at the same time.

If you are looking for an emergency fund that you’ll need to tap into at a moment’s notice, securities are not the right place for your money. You have to wait for it to mature before you can cash it in. If you need the money before it matures, you might have to sell your treasury at a loss. However, what if you know you won't need the money for a few years, and you do not like the risk of the stock market? Treasury securities would be a good choice in this situation. Some people also like to put their money in securities with spaced-out maturities, such as splitting your money between 3 and 6 month T-Bills that mature two months apart. This way every two months you can re-evaluate whether Treasury Securities are earning you the best rate. If they are, you can just immediately reinvest it; if not you can remove your money and invest it elsewhere. It also gives you better liquidity than if all your securities matured at the same time.

One benefit of T-Notes and T-Bonds is that they pay interest every 6 months. You receive some money without having to take out your investment, which is impossible in the stock market. The downside to this is that your interest is not compounded. Treasury Securities are a good choice for money you cannot risk since they are backed by the government. They are also a good choice when you can wait for them to mature, otherwise you run the risk of losing money.

You should evaluate your risk level and situation to determine if tresauries are right for you.

You should evaluate your risk level and situation to determine if tresauries are right for you.

No comments:

Post a Comment