Have you ever considered investing in corporate bonds? Corporate bonds are issued by companies as a way to raise money. You are essentially lending them money and they will pay you back with interest. They promise to return your money when the bond matures. Corporate bonds are not equal to stocks -they give you no holdings in the company. Think of yourself more as a bank in this case, lending money out to a company. Corporate bonds can range from one to thirty years. Usually you will receive interest semi-annually in payments known as coupons. This means that you receive a regular income from these bonds.

Corporate bonds are not for the inexperienced investor. If you want to invest in corporate bonds, you need to know how to read and understand a company’s balance sheet; comparing their debt to their assets. You should be able to predict the company’s future business prospects and future cash flow. It is important to analyze the company’s business to know how much of a chance there is that a company will default on their loans. If the company defaults, usually bond holders will get their money back, but their profit is often negligible.

It is important to know whether your bond is callable. This means that if interest rates drop, the company has the right to pay off the bond immediately (meaning you won’t make as much) so they can issue new bonds at a lower interest rate. If your bond is callable, you should be receiving a higher interest rate.

It is also important to note any other events that could impact the company whose bond you are buying. For instance, if your company buys another company, its debt might go up, which increases its risk of defaulting on your bond.

Corporate bonds will always have higher rates than government backed securities, but this is because they are a much higher risk. However, they do not all hold the same risk. Their risk is based upon their credit risk, or risk of defaulting. Agencies such as Moody’s or Standard & Poor’s can tell you a company’s credit risk. The lower the grade (higher credit risk) a company has, the higher the risk you are taking by lending them money. However, these companies will offer a higher yield. You will need to balance how much risk you are willing to take with how much yield you want.

Lastly, the longer your bond takes to mature, the higher yield you will receive (usually).

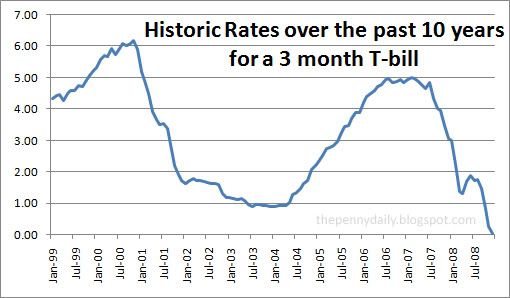

Corporate bonds are extremely easy to liquidate. There is a large market for buying and selling corporate bonds. However, it is important to consider interest rates when you are selling a bond before maturity. If interest rates have dropped since you bought the bond, your bond will likely be worth more on the market since the bonds issued more recently will be at lower rates, making yours worth more. The opposite is true if interest rates have risen since you bought the bond. Your bond will likely be worth less since bonds issued more recently will be worth more since they have higher rates.

Another factor that can affect the price you will get for your bond is the credit spread between government issued bonds and the corporate bond you own. If the difference in percent yield is high, that is a wide credit spread; if it is low, a narrow credit spread. If the credit spread narrows, because say the company’s risk went down and is not considered as risky of an investment, future bonds will have a lower yield. This means your bond will be worth more. As the credit spread widens, if the company’s risk goes up, future bonds will have a higher yield, making yours worth less.

Those two factors only really matter if you are planning to sell your bond. If you keep it to maturity, assuming the company doesn’t default or recall your loan by paying you back early, you will receive the amount it is worth. However, those factors are still worth considering in case there is an emergency and you need to liquidate your bonds unexpectedly.

Now, how do corporate bonds fit into today’s economy? So far this month, 15 (14 US based companies) have defaulted on their loans. This is triple the number for just one year ago. Last year 126 companies throughout the world defaulted, three quarters of which were from the United States, and most were from the second half of the year. Yet in 2007, only 22 defaulted worldwide. Due to the bad economy/credit problems, companies now are more likely to default. One analyst from Standard & Poor’s predicts that there will be an average of 17 defaults a month this year. How does this impact corporate bonds? Well, the more likely it is that the company will default, the higher yield they will offer. Buying a corporate bond now will likely have a high yield due to increased risk.

As with any investment, you should consider your financial situation.